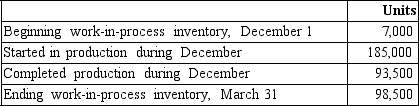

Titan Manufacturing uses a process cost system. The following information pertains to operations for the month of December.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs. The ending inventory was 85% complete for materials and 30% complete for conversion costs.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs. The ending inventory was 85% complete for materials and 30% complete for conversion costs.

Costs pertaining to the month of December are as follows:

Beginning inventory costs are: materials, $38,200; conversion cost $41,400.

Costs incurred during December are: materials used, $462,300; conversion cost $602,700.

Required:

A. Using the weighted average method calculate the total equivalent units of production for direct materials and conversion cost.

B. Using the weighted average method, calculate the unit cost of materials and conversion for December.

C. Using the weighted average method, calculate the total cost of the units in the ending work-in-process inventory at December 31.

Definitions:

Nuclear Fusion

A reaction in which two or more atomic nuclei come very close and then collide at a high speed and join to form a new nucleus.

Light Bulb

An electric device that produces light from electricity, consisting of a filament held within a glass sphere that illuminates when current passes through it.

Computer Keyboard

A computer keyboard is a peripheral input device used to input text and commands into a computer system via the press of keys.

Crumbs

Small fragments or pieces of bread, cake, or other baked goods, often left after eating.

Q14: Dirth Company sells only one product at

Q15: In process costing, each producing department has

Q52: variable cost per unit<br>A)horizontal-axis of CVP graph<br>B)vertical-axis

Q53: Information for Crisby Company is as follows:<br><img

Q85: Just-in-time<br>A)the costs of not having a product

Q98: Common fixed expenses are the fixed costs

Q101: The _ is the number of units

Q145: Tires Unlimited Corp. produces two types of

Q148: A volume-based costing system emphasizes direct tracing

Q150: Environmental costs which the firm is not