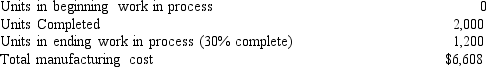

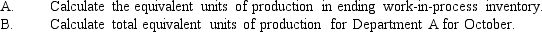

Figure 6-8.Department A had the following data for October:

-Refer to Figure 6-8.

Definitions:

Marginal Tax Rate

The tax rate applied to the last dollar of income, representing the percentage of tax paid on any additional dollar of income.

Taxable Income

The portion of an individual's or entity's income used to calculate how much tax they owe to the government, after deductions and exemptions.

Regressive

Relating to a tax system in which the tax rate decreases as the taxable amount increases, often considered less fair to lower-income individuals.

Progressive

Pertaining to ideas, policies, or attitudes favoring progress, change, improvement, or reform, particularly in social conditions.

Q10: A factory produces 124,000 televisions per quarter.

Q12: Refer to Figure 6-3. Kelley's equivalent units

Q39: Production costs consist of direct materials, direct

Q72: Refer to Figure 9-8. What are the

Q81: The Tilman Corporation has seen a significant

Q86: In the equation to determine the number

Q113: Abrams Bottling Company sells fruit-flavored colas. Estimated

Q136: The difference between actual overhead and applied

Q144: the costs of job are transferred from

Q166: Refer to Figure 4-4. Now suppose that