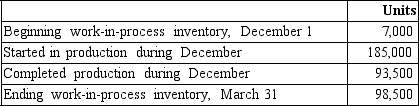

Titan Manufacturing uses a process cost system. The following information pertains to operations for the month of December.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs. The ending inventory was 85% complete for materials and 30% complete for conversion costs.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs. The ending inventory was 85% complete for materials and 30% complete for conversion costs.

Costs pertaining to the month of December are as follows:

Beginning inventory costs are: materials, $38,200; conversion cost $41,400.

Costs incurred during December are: materials used, $462,300; conversion cost $602,700.

Required:

A. Using the weighted average method calculate the total equivalent units of production for direct materials and conversion cost.

B. Using the weighted average method, calculate the unit cost of materials and conversion for December.

C. Using the weighted average method, calculate the total cost of the units in the ending work-in-process inventory at December 31.

Definitions:

Money Income

The total amount of monetary earnings or receipts accruing to an individual or household over a specified period of time.

Purchasing Power

The value of a currency expressed in terms of the amount of goods or services that one unit of money can buy.

Market Demand Curve

A graphical representation showing the quantity of a good that consumers are willing and able to purchase at different price points, holding other factors constant.

Horizontal Sum

The process of adding the quantities demanded by all individuals at different price levels to determine the total market demand at each price.

Q2: Refer to Figure 6-3. Kelley's total costs

Q50: A company was evaluating the activity-based environmental

Q55: The use of a departmental rate has

Q56: The unit information section of the production

Q79: The presence of beginning and ending work-in-process

Q145: _ is the use of fixed costs

Q145: Refer to Figure 5-11. The journal entry

Q155: Process costing accumulates costs by individual jobs.

Q168: Under the _ method equivalent units of

Q182: Sanders Manufacturing has the following amounts listed