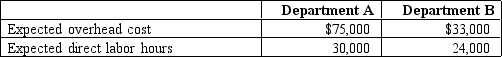

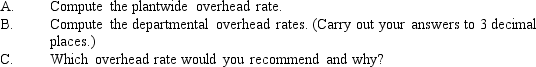

Feline Company uses a normal job-order costing system. Currently, a plantwide overhead rate based on direct labor is used. Lola Katz, the plant manager, has heard that departmental overhead rates can offer significantly better cost assignments than a plantwide rate can offer. Some jobs spend most of their time in Department A, while others spend most of their time in Department B. Feline has the following data for its two departments for the coming year:

Definitions:

Net Operating Income

A measure of a property's profitability, calculated by subtracting all operating expenses from the gross operating income.

Variable Costing

An accounting method that considers only variable production costs (such as materials and labor) in the calculation of product costs.

Net Operating Income

The profit derived from a company's regular business operations after deducting operating expenses such as rent, wages, and utilities.

Direct Labor Cost

The total cost of workforce expenses directly involved in the manufacturing of products or delivery of services, excluding indirect labor costs.

Q7: A production report is divided into two

Q46: Sales can decline by how much before

Q69: factory supervisor's salary<br>A)variable<br>B)fixed

Q96: The cost-volume profit graph depicts the relationships

Q128: Royal, Inc., manufactures products that pass through

Q139: The contribution margin income statement provides a

Q157: A company has two inspectors, each earning

Q167: In job-order costing, the journal entry for

Q176: Refer to Figure 5-5. What is the

Q221: A discretionary fixed cost can be changed