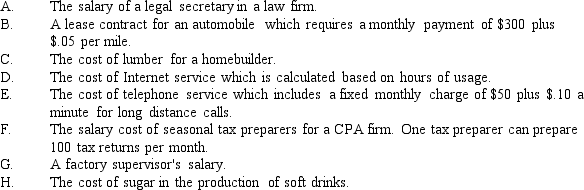

Consider each of the following independent situations.

Required: For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost.

Required: For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost.

Definitions:

Systematic Risk

The risk inherent to the entire market or market segment, not reducible through diversification.

Security Market Line

A line on a chart that displays the relationship between risk and the expected return of the market portfolio. It serves as a graphical representation of the Capital Asset Pricing Model (CAPM).

Beta Coefficient

A framework for quantifying the variability, or orderly risk, of a security or investment compilation when juxtaposed with the general market.

Risk Premium

The additional return an investor demands for choosing a risky investment over a risk-free option, serving as compensation for the additional risk.

Q1: Relationship between dividends and the market price

Q19: indirect materials<br>A)variable<br>B)fixed

Q35: The primary objective of managerial accounting is<br>A)

Q57: Sum of the dividend payout and stock

Q66: Public companies file their annual reports on

Q96: Refer to Figure 3-14. Using a regression

Q146: Refer to Figure 5-8. Calculate the ending

Q172: Refer to Figure 5-3. Mitchell decides to

Q196: If actual overhead for the year is

Q245: Salary of chief executive officer<br>A)selling expense<br>B)administrative expense<br>C)direct