Grindgood Company operates a chain of cozy coffee shops. The company's chief executive officer is interested in accumulating some information on the overhead costs incurred by the company. You have been asked to analyze the following six months worth of data.

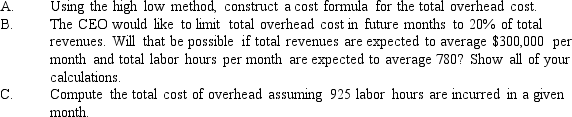

Required:

Definitions:

Unearned Fees

Income received by a business for services that have yet to be performed or delivered, considered a liability until the service is completed.

Unearned Revenue

Money received by a company for goods or services that have yet to be provided to the customer.

Accrued Wages

Salaries or wages that have been earned by employees but have not yet been paid by the company.

Net Income

What a company ultimately earns in profit once expenses and taxes are removed from its total income.

Q4: The length of the operating cycle is

Q7: Labor cost flows reflect<br>A) direct labor cost.<br>B)

Q40: total cost = total fixed cost +

Q69: Rancor Inc. had a per-unit conversion cost

Q96: each financial statement line item is expressed

Q97: Refer to Figure 2-8. Total period expense

Q97: The following information was included in a

Q112: Which of the following sentences is not

Q183: license fees on automobiles<br>A)variable<br>B)fixed

Q245: Salary of chief executive officer<br>A)selling expense<br>B)administrative expense<br>C)direct