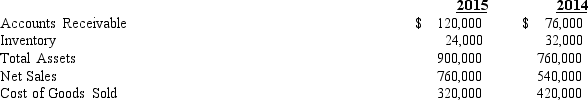

Selected data from the financial statements are provided below:

Rags to Riches

-Refer to Rags to Riches. Which of the following would result from a vertical analysis of the company's income statement?

Definitions:

Debt-to-Equity Ratio

A financial metric that shows the balance between the equity provided by shareholders and the debt leveraged to support a company's assets.

Working Capital

The difference between a company's current assets and current liabilities, indicating the liquidity available for its day-to-day operations.

Long-term Liabilities

Financial obligations of a business that are due more than one year in the future, such as bonds payable or long-term loans.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year.

Q5: Received payments from accounts receivable.

Q69: The net profit margin percentage reflects the

Q74: Cost of partially completed goods<br>A)Income Statement<br>B)Cost of

Q135: Using debt to help the company earn

Q137: Midtown Diner, Inc., purchased $10,000 of paper

Q142: Spangle Company constructed the following cost formula

Q187: Refer to Rent-a-Center. Which of the following

Q217: Refer to Landmark Company. What is the

Q226: Dividends that are paid out of contributed

Q232: A manufacturer normally has<br>A) one inventory account.<br>B)