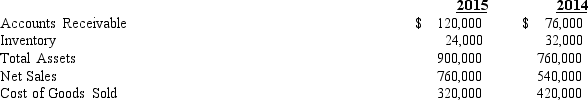

Selected data from the financial statements are provided below:

Rags to Riches

-Refer to Rags to Riches. Which of the following would result from a horizontal analysis of the company's balance sheet?

Definitions:

Times-Interest-Earned Ratio

A measure of a company's ability to honor its debt payments, calculated by dividing earnings before interest and taxes (EBIT) by interest expenses.

Equity Multiplier

A ratio of financial leverage that calculates the proportion of a company's assets funded by its shareholders' equity.

Total Assets Turnover Ratio

Measures the turnover of all the firm’s assets; it is calculated by dividing sales by total assets.

Debt Ratio

A financial ratio that measures the extent of a company’s or individual's leverage, calculated by dividing total liabilities by total assets.

Q1: Private corporations typically issue their stock to

Q12: If a company's current ratio is 1.5

Q15: Provides that current dividends must be paid

Q25: A growing corporation had $180,000 of its

Q51: Return on assets ratio

Q78: List and describe the three categories of

Q127: Refer to Maritime Marine Services. Assuming that

Q175: When using the direct method to determine

Q219: As a general rule, all users of

Q219: The stockholders' equity section of the balance