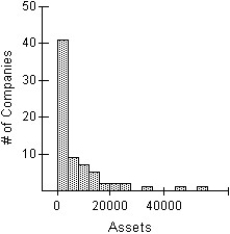

Here is a histogram of the assets (in millions of dollars) of 71 companies.

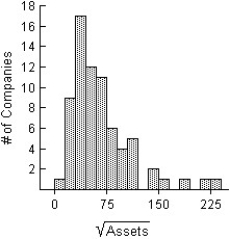

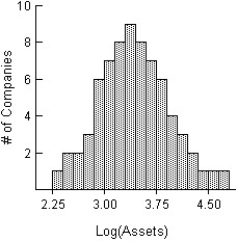

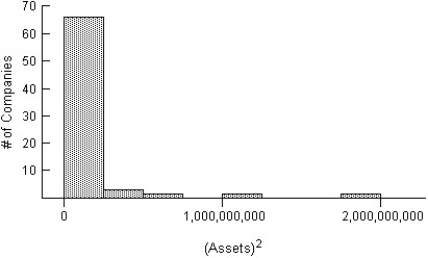

Which of the following is the most appropriate re-expression of these data? Explain.

I II

III

Definitions:

Long-term Assets

Assets that are expected to provide economic benefits over a period longer than one fiscal year, such as land, buildings, and equipment.

Short-term Investments

Financial assets that are expected to be converted into cash or sold within a year.

Cash Equivalents

Short-term, highly liquid investments that are readily convertible to known amounts of cash and so close to their maturity that they present insignificant risk of changes in value due to changes in interest rates.

Net Change

Net Change refers to the difference in a financial instrument's closing price between two consecutive trading sessions.

Q2: A local ice cream shop hand scoops

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3448/.jpg" alt=" A)Model is not

Q13: The human resources manager of a large,well-known

Q23: A university in your region estimates that

Q28: The weekly salaries (in dollars)of 24 randomly

Q37: A random sample of 150 yachts sold

Q37: A survey of automobiles parked in student

Q45: A business owner recorded her annual profits

Q58: A survey of automobiles parked in student

Q69: 4) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3448/.jpg" alt="4)