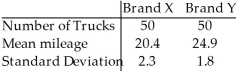

The table below gives information concerning the gasoline mileage for random samples of trucks of two different types.Find a 95% confidence interval for the difference in the means

-

.

Definitions:

Frequency Recording

A method of data collection in behavioral analysis that involves counting the number of times a specific behavior occurs within a set period.

Latency Recording

A variation of duration recording in which an observer records how long it takes a student to begin engaging in a behavior after the teacher instructs the student to perform it.

Interval Recording

A data collection method where the observation period is divided into intervals, and the presence or absence of behavior is recorded in each interval.

Counting Behavior

The process of systematically tallying instances of a specific behavior for the purpose of analysis or intervention.

Q6: Tests for adverse reactions to a new

Q19: One of the major reasons that corporations

Q26: Which of the following organization forms earns

Q26: The debt-equity ratio is a common ratio

Q31: A study was made to determine which

Q32: Which of the following statements is false?<br>A)

Q38: In studying the responses to a multiple-choice

Q58: A laboratory worker finds that 1.6% of

Q68: Assuming that Luther has no convertible bonds

Q97: Police estimate that 25% of drivers drive