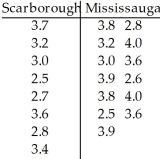

A researcher was interested in comparing the GPAs of students at the University of Toronto Scarborough and Mississauga campuses.Independent random samples of 8 students from the Scarborough campus and 13 students from the Mississauga campus yielded the following GPAs.

Use software to compute a 95% bootstrap confidence interval for the difference in sample medians based on 1000 resamples.

Definitions:

Long-Term Sources

Financing options available to a business that have a repayment period of more than one year, such as bonds or long-term loans.

Marketable Securities

Financial instruments that are easily convertible into cash, typically with high liquidity and short maturity periods, such as stocks and bonds.

Another Company

This term refers to an entity different from the one currently being discussed or involved.

Volatile Interest Rates

Interest rates that fluctuate frequently and unpredictably, often affecting borrowing and saving costs.

Q1: The paired data below consist of the

Q14: The data will be analyzed to determine

Q24: Consider the following data from an experiment

Q35: An electrical engineer wants to compare the

Q39: The effective annual rate on your firm's

Q41: The Principal-Agent Problem arises<br>A) because managers have

Q50: Which of the following statements is false?<br>A)

Q54: How much fat do reduced fat cookies

Q56: If the interest rate is 6%,then the

Q59: The change in Luther's quick ratio from