Use the table for the question(s) below.

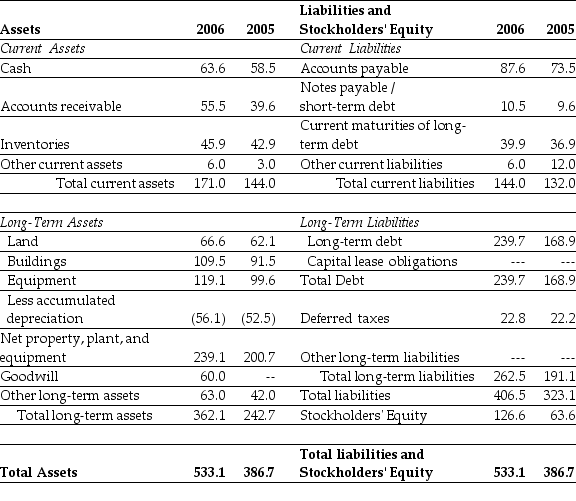

Consider the following balance sheet:

-If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

Definitions:

Personal Identity

An individual's self-concept formed by personal attributes, values, goals, and social relationships.

Emerging Adulthood

A phase of life between adolescence and full-fledged adulthood which encompasses late teens through the twenties, marked by exploration and self-discovery.

Adolescence

The period of development that occurs between childhood and adulthood, marked by significant physical, psychological, and social changes.

Early Childhood

The period of a child's life from birth to the beginning of formal education, often considered to be up to the age of 8 years.

Q6: A grass seed company conducts a study

Q28: A random sample of 50 adult males

Q29: The Professional Golfer's Association (PGA)wants to know

Q34: You own 100 shares of a publicly

Q35: Applicants for a particular job,which involves extensive

Q37: In Canada,which of the following organization forms

Q43: Applicants for a particular job,which involves extensive

Q76: Which of the following statements is false?<br>A)

Q77: If firm's objective is to maximize wealth,<br>A)

Q80: You have been offered the following investment