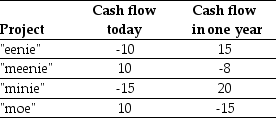

Use the table for the question(s) below.

-If the risk-free interest rate is 10%,then the NPV for "eenie" is closest to:

Definitions:

Strike Price

The price at which the holder of an option contract can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset or security.

Option Price

The price at which the holder of an option can buy (in the case of a call option) or sell (in case of a put option) the underlying asset.

Put Option Contracts

A financial instrument that gives the holder the right, but not the obligation, to sell a specified amount of an underlying security at a predetermined price within a specified time frame.

Exercise Price

The specified price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

Q20: Suspecting that a die may be unfair,you

Q23: Which of the following statements is false?<br>A)

Q29: The CCA tax shield is nothing more

Q30: Compare the technique for decision making about

Q35: Canadian mortgages are quoted with APRs using

Q46: If the discount rate for project B

Q51: Test the claim that the proportion of

Q62: You are considering purchasing a new automobile

Q71: A car insurance company performed a study

Q99: Assuming the appropriate YTM on the Sisyphean