Use the information for the question(s) below.

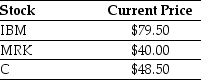

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

-Assume that the ETF is trading for $426.00.What (if any)arbitrage opportunity exists? What (if any)trades would you make?

Definitions:

Modus Tollens

A form of logical argument where the denial of the consequent leads to the denial of the antecedent, symbolically represented as "If P then Q; not Q; therefore not P."

Hypothetical

Based on or serving as a hypothesis, suggesting a possible scenario or assumption for the sake of argument.

Hypothetical Syllogism

A form of logical argument involving two conditional statements and a conclusion that infers a relationship based on the preceding premises.

Tasted Awful

Describes a very unpleasant flavor experienced when consuming certain foods or drinks.

Q3: An independent research firm conducts a study

Q6: Tests for adverse reactions to a new

Q8: An industrial engineer wants to test the

Q17: Assume that Kinston's new machine will be

Q21: Here are histograms of the leverage and

Q24: Explain the main differences between the NYSE

Q39: A horticulturist wants to test the effectiveness

Q40: The incremental EBIT for Shepard Industries in

Q46: Which of the following statements is false?<br>A)

Q61: Assuming the appropriate YTM on the Sisyphean