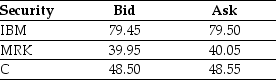

Use the table for the question(s) below.

-Consider an ETF that is made up of one share each of IBM,MRK,and C. The current quote for this ETF currently is $167.75 (bid)$167.85 (ask).What should you do?

Definitions:

Ending Inventory

Ending inventory is the total value of goods available for sale at the end of an accounting period, calculated as beginning inventory plus purchases minus cost of goods sold.

Current Assets

Items of value that are likely to be cashed in, sold off, or used up within a twelve-month period or during the standard operational cycle of a company.

Gross Profit

The financial metric representing the difference between revenues and the cost of goods sold, indicating the basic profitability of a company's core operations.

Operating Expenses

Costs associated with running a business's day-to-day operations, excluding costs related to producing goods or services.

Q4: Suppose that Bondi Inc.is a Canadian holding

Q5: A coach uses a new technique in

Q15: You are saving for retirement.To live comfortably,you

Q21: The payback period for project Beta is

Q22: A publishing company performs sample surveys to

Q31: If Luther's accounts receivable were $55.5 million

Q46: If the discount rate for project B

Q48: The Time Value of Money (TVM)is defined

Q51: Test the claim that the proportion of

Q68: Assuming that Luther has no convertible bonds