Use the table for the question(s) below.

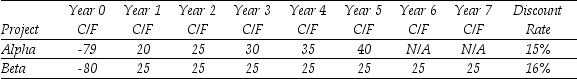

Consider the following two projects with cash flows in $:

-The NPV for project Beta is closest to:

Definitions:

Capital Structure

The mix of different forms of financing used by a company, such as debt, equity, and other types of financing.

Cost of Equity

The return that investors expect for providing capital to a company, often estimated using models like the Dividend Discount Model (DDM) or the Capital Asset Pricing Model (CAPM).

Unlevered Cost of Capital

Refers to the cost of capital for a firm that has no debt, representing only the cost of equity.

Financial Leverage

The use of borrowed money (debt) to amplify the potential return of an investment or project.

Q3: Forward interest rates tend<br>A) to accurately predict

Q5: Assuming you just purchased 10,000 Bbls of

Q7: Consider a zero coupon bond with 20

Q18: A random sample of 50 students were

Q24: Consider the following data from an experiment

Q34: Suppose that Defenestration decides to pay a

Q47: A normal market where there are no

Q48: Which of the following statements is false?<br>A)

Q53: The forward rate for year 4 (the

Q103: Assuming the appropriate YTM on the Sisyphean