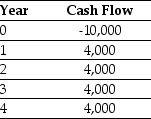

Use the table for the question(s) below.

Consider a project with the following cash flows:

-Assume the appropriate discount rate for this project is 15%.The payback period for this project is closest to:

Definitions:

Triangle

A geometric shape consisting of three sides and three angles.

Gold

A yellow precious metal, highly valued for its rarity, durability, and shiny luster, used for currency, jewelry, and other art objects.

Pencil

A writing instrument made of a narrow, solid pigment core encased in a protective casing that prevents the core from being broken and marks from being made on the user's hand.

Concepts

Mental representations that organize and categorize the world around us, allowing individuals to understand and interact with their environment intelligently.

Q2: The price of a five-year,zero-coupon,default-free security with

Q2: To calculate a loan payment,we first compute

Q8: After examining the yield curve,what predictions do

Q22: With month payment of $580 into a

Q29: Which of the following statements is false?<br>A)

Q36: When money moves forward on the timeline,the

Q41: Why is the firm's statement of cash

Q51: You have an investment opportunity that will

Q71: You are offered an investment opportunity that

Q99: Assuming the appropriate YTM on the Sisyphean