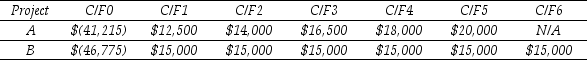

Use the table for the question(s)below.

Consider two mutually exclusive projects with the following cash flows:

-If the discount rate for project A is 16%,then what is the NPV for project A?

Definitions:

Monetary Incentives

Financial rewards given to motivate behavior or performance.

Hypotheses

Tentative explanations or predictions that can be tested through empirical research and observation.

Ethics Code

A set of guidelines designed to help professionals conduct business honestly and with integrity.

Informed Consent

A process by which a fully informed person can participate in choices about their health care or participation in research after understanding the risks, benefits, and alternatives involved.

Q3: Which of the following equations is incorrect?<br>A)

Q23: Suppose a security with a risk-free cash

Q24: Suppose you plan to hold Von Bora

Q24: Assuming that the EFT you invested in

Q28: The change in net working capital from

Q37: Which of the following is NOT a

Q42: The highest effective rate of return you

Q44: What is Luther's net working capital in

Q54: How much will each semi-annual coupon payment

Q69: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1619/.jpg" alt="Consider