Use the information for the question(s) below.

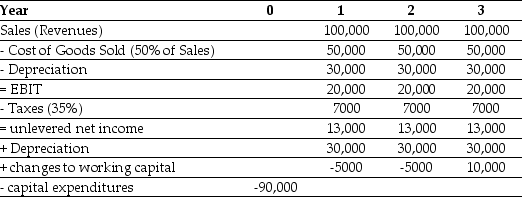

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-The free cash flow for the last year of Epiphany's project is closest to:

Definitions:

Q2: To calculate a loan payment,we first compute

Q3: Following the Sarbanes-Oxley Act in United States,Canadian

Q7: Suppose that Defenestration decides to pay a

Q18: What are the implications of the efficient

Q24: Assuming that the EFT you invested in

Q28: Government of Canada Bonds pay coupons in

Q41: In Canada,the only effect of Capital Cost

Q68: Define the following terms:<br>(a)perpetuity<br>(b)annuity<br>(c)growing perpetuity<br>(d)growing annuity

Q69: For 10-year Canadian Savings Bonds,<br>A) the interest

Q80: You have been offered the following investment