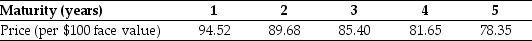

Use the table for the question(s) below.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value) :

-The yield to maturity for the two-year zero-coupon bond is closest to:

Definitions:

Abrupt Price Drop

A rapid and significant decrease in the market price of a security or commodity.

Blanket Liens

A legal claim allowing a lender to seize nearly all of a borrower's assets if they default on a loan.

Chattel Mortgage

A loan arrangement in which an item of movable personal property acts as security for the loan, often used in the financing of vehicles and equipment.

Speculative Demand

The demand for a good or asset based on expectations of future price changes, rather than its intrinsic value or productive use.

Q7: The amount that Ford Motor Company owes

Q15: You are saving for retirement.To live comfortably,you

Q21: The standard deviation of the returns on

Q23: Assuming that your capital is constrained,which project

Q29: When the coupon rate of a bond

Q63: You are offered an investment opportunity in

Q63: _ portfolio of risky securities must _

Q85: CAPM states that the investment's expected return

Q88: The standard deviation of the returns on

Q95: The average annual return on IBM from