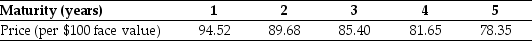

Use the table for the question(s)below.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

-Compute the yield to maturity for each of the five zero-coupon bonds.

Definitions:

Marginal Tax Rate

The rate at which the last dollar of a person's income is taxed, indicating how much tax will be paid on an additional dollar of income.

Income Before Taxes

The gross income a person or corporation earns before taxes are deducted.

Marginal Tax Rate

The rate at which an additional dollar of income is taxed, serving as a useful measure of the impact of taxes on incentives to earn more.

Average Tax Rate

The ratio of the total amount of taxes paid to the taxpayer's total taxable income.

Q3: California Gold Mining's beta with the market

Q10: Which of the following formulas is incorrect?<br>A)

Q18: What are three main assumptions underlie the

Q20: The present value of the lease payments

Q24: Which of the following statements is false?<br>A)

Q38: A nominal interest rate is normally composed

Q51: Money that has been or will be

Q65: Consider the following timeline detailing a stream

Q67: In Canada,one of the reasons that the

Q75: Will adding the precious metals fund improve