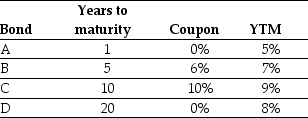

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:

-The percentage change in the price of the bond "A" if its yield to maturity increases from 5% to 6% is closest to:

Definitions:

Systematic Risk Principle

A principle stating that investors need to be compensated for taking on increased levels of undiversifiable risk.

Not Correlated Stocks

Stocks whose price movements are independent of each other, indicating no direct relationship in their performance.

Volatility

The degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns.

Negatively Correlated Stocks

Stocks that move in opposite directions; when the price of one increases, the price of the other tends to decrease.

Q9: The price today of a 4-year default-free

Q34: Which of the following statements is false?<br>A)

Q35: The payback period for project A is

Q47: The volatility on Home Depot's returns is

Q48: The British government has a consol bond

Q68: Which of the following statements is false?<br>A)

Q70: Which of the following statements is false?<br>A)

Q77: Suppose that you want to use the

Q86: The total return of a stock is

Q95: The beta of a security captures the