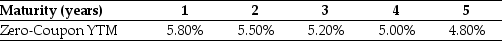

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The price today of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

Definitions:

Projected Cash Flows

Estimates of the amount of money expected to flow in and out of a business over a future period.

Time Value of Money

The principle that a dollar received today is worth more than a dollar received in the future, due to its potential earning capacity.

Hurdle Rate

The minimum acceptable rate of return on an investment that a manager or investor expects to achieve.

Q8: Which of the following investment opportunities provides

Q15: When the IRR rule is used for

Q20: Consider two securities,A & B.Suppose a third

Q24: Investors appear to put too _ weight

Q37: The incremental unlevered net income for Shepard

Q60: No arbitrage is equivalent to the idea

Q66: Consider a zero coupon bond with 20

Q67: Important choices in estimating beta include all

Q94: Assuming that Luther's bonds receive a AAA

Q103: Which of the following statements is false?<br>A)