Multiple Choice

Use the table for the question(s) below.

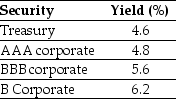

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

Definitions:

Related Questions

Q6: You have an investment opportunity in Germany

Q18: Suppose you invest $1000 into a mutual

Q21: The standard deviation of the returns on

Q24: Assuming that the EFT you invested in

Q28: Which of the following formulas is incorrect?<br>A)

Q59: Which of the following statements is false?<br>A)

Q72: Which of the following statements is false?<br>A)

Q82: A 4-year default-free security with a face

Q89: The capital market line (CML)represents the highest

Q93: Which of the following statements is false?<br>A)