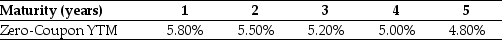

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-Which of the following statements is correct?

Definitions:

Insurance Agent

a professional who sells, solicits, or negotiates insurance policies on behalf of an insurance company to clients.

Bearer Instruments

Financial documents that entitle the holder or bearer to a sum of money or value stated on the document, without requiring ownership registration.

Indorsement

An act of signing a document, often found on the back of a check, to transfer rights or to authenticate.

Negotiating

The process of discussing and arriving at a mutual agreement between parties with differing needs or viewpoints.

Q2: Which of the following statements regarding the

Q2: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1619/.jpg" alt="The term

Q11: A Canadian company issues an 8-year term

Q41: It has long been told that the

Q49: Both conservative and aggressive investors will choose

Q56: The weight on Lowes in your portfolio

Q87: Which of the following statements is correct?<br>A)

Q88: Since the CCA deducted each year is

Q93: You are considering investing $600,000 in a

Q94: Assuming that Luther's bonds receive a AAA