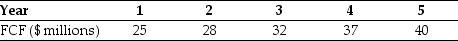

Use the information for the question(s) below.

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-If CCM has $150 million of debt and 12 million shares of stock outstanding,then the share price for CCM is closest to:

Definitions:

Production Bottleneck

A condition that occurs when product demand exceeds production capacity.

Manufacturing Costs

Expenses directly related to the production of goods, including raw materials, labor, and overhead expenditures.

Product Cost Concept

The product cost concept encompasses all costs associated with the creation of a product, including materials, labor, and overhead, used for pricing and inventory valuation.

Opportunity Cost

The forfeit of potential benefits from different options when a specific choice is made.

Q4: How does scenario analysis differ from sensitivity

Q22: Suppose that to raise the funds for

Q26: The effective annual rate (EAR)for a loan

Q31: Assuming that Tom wants to maintain the

Q31: The size effect reflects the fact that

Q47: If you want to value a firm

Q51: The variance on a portfolio that is

Q67: Which of the following equations is incorrect?<br>A)

Q67: In Canada,one of the reasons that the

Q71: Which of the following types of risk