Use the information for the question(s)below.

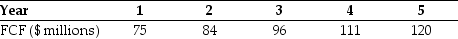

You expect DM Corporation to generate the following free cash flows over the next five years:  Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

-If DM has $500 million of debt and 14 million shares of stock outstanding,then what is the price per share for DM Corporation?

Definitions:

Net Realizable Value

The estimated selling price of goods, minus the costs of their sale or completion, used in determining the value of inventory on hand.

LIFO

An inventory valuation method standing for Last-In, First-Out, where the most recently acquired items are assumed to be sold or used first.

FIFO

FIFO (First In, First Out) is an inventory valuation method where the oldest inventory items are recorded as sold first.

Fair Value

The estimated market value of an asset or liability, based on current market prices.

Q13: Which of the following statements is false?<br>A)

Q30: The capital market line (CML)represents _ expected

Q36: Which of the following statements is false?<br>A)

Q45: Which of the following statements is false?<br>A)

Q46: The target range of annual inflation rates

Q52: The geometric average annual return on the

Q56: Consider an ETF that is made up

Q95: Assuming that Luther's bonds receive a AAA

Q97: Assuming that the risk-free rate is 4%

Q100: Which of the following statements is false?<br>A)