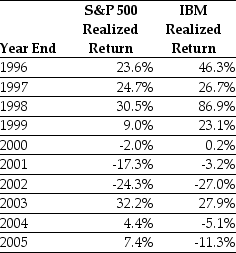

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on IBM to forecast the expected future return on IBM.The 95% confidence interval for your estimate of the expect return is closest to:

Definitions:

Butterfly needle

A small, winged needle used for accessing veins for blood draws or infusions, minimizing discomfort and tissue damage.

Blood chemistries

Tests performed on a blood sample to measure the levels of certain substances in the blood, providing information about organ function and detecting diseases.

HIV/AIDS

A spectrum of conditions caused by infection with the human immunodeficiency virus (HIV), leading to the progressive failure of the immune system (AIDS) and increased susceptibility to opportunistic infections and tumors.

Antibody tests

Blood tests that look for antibodies in your blood to determine past exposure to certain infections or diseases or to assess your immune system's response to vaccination.

Q27: Independent risk is also called<br>A) undiversifiable risk.<br>B)

Q31: With perfect capital markets,leverage has _ effect

Q38: Which of the following statements is false?<br>A)

Q47: If there is a significant risk that

Q53: The relationship between risk and return for

Q56: Assume that you purchased Ford Motor Company

Q80: In practice which market index would best

Q88: The standard deviation of the returns on

Q101: Consider a bond that pays annually an

Q105: Consider an equally weighted portfolio that contains