Multiple Choice

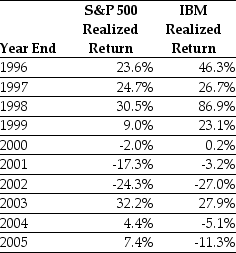

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on IBM to forecast the expected future return on IBM.The standard error of your estimate of the expect return is closest to:

Definitions:

Related Questions

Q8: Suppose you own 10% of the equity

Q21: Assume that you have $100,000 to invest

Q46: The free cash flow for the first

Q58: The market value for Bernard Industries is

Q64: Monsters Inc.is a utility company that recently

Q68: Which of the following formulas is incorrect?<br>A)

Q68: The profitability index for project A is

Q74: Which of the following statements is false?<br>A)

Q77: Suppose that you want to use the

Q85: Suppose that to raise the funds for