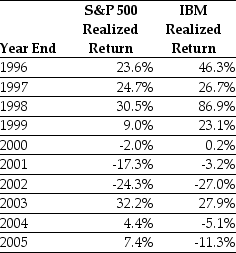

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on the S&P 500 to forecast the expected future return on the S&P 500.The 95% confidence interval for your estimate of the expect return is closest to:

Definitions:

U.S. Marines

A branch of the United States Armed Forces responsible for providing power projection and amphibious warfare capabilities.

Dictator

A ruler with absolute power over a country, typically one who has obtained control by force rather than by democratic means.

Nicaragua

A country in Central America known for its significant biodiversity, historical political turmoil, and as a site of intervention by foreign powers.

Meyer v. Nebraska

A 1923 Supreme Court case that ruled a Nebraska law restricting foreign-language education violated the Fourteenth Amendment, emphasizing individual rights.

Q4: If the market portfolio is efficient,the relationship

Q8: Describe two methods that can be used

Q11: To determine the benefit of leverage for

Q34: Monsters' required return is closest to:<br>A) 10.0%<br>B)

Q37: Which of the following statements is false?<br>A)

Q38: Which of the following statements is false?<br>A)

Q69: Stocks with lower market capitalizations have _

Q69: The Sharpe ratio for your portfolio is

Q84: What is the variance on a portfolio

Q103: Assuming the appropriate YTM on the Sisyphean