Multiple Choice

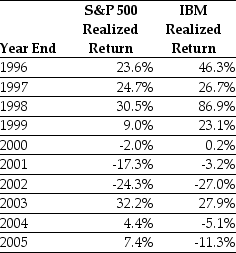

Use the table for the question(s) below.

Consider the following realized annual returns:

-The geometric average annual return on IBM from 1996 to 2005 is closest to:

Definitions:

Related Questions

Q2: In a perfect capital market,the total value

Q8: Which of the following statements is false?<br>A)

Q12: Suppose that the risk-free rate is 5%

Q43: In Canada,by regulation,how many times is a

Q62: Which of the following statements is false?<br>A)

Q63: Assume that Kinston's new machine will be

Q65: The expected return on the precious metals

Q74: The yield to maturity of a bond

Q86: When a Canadian firm uses debt,the interest

Q97: Which of the following statements is false?<br>A)