Use the table for the question(s) below.

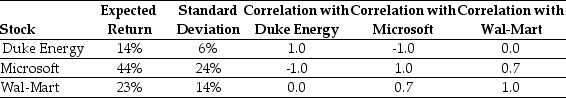

Consider the following expected returns, volatilities, and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

Definitions:

Operating Costs

Expenses associated with the routine functioning of a business or system.

Long-Term Gains

Profits or advantages achieved over an extended period, contrasting with immediate or short-term benefits.

Cost of Goods Sold

An accounting term referring to the direct costs attributable to the production of goods sold by a company.

Rent Expense

A periodic payment made by a tenant to a landlord for the use of premises, buildings, or land.

Q2: After the recapitalization,the value of KD's levered

Q12: What is Luther's enterprise value?<br>A) $16 billion<br>B)

Q15: Which of the following statements is false?<br>A)

Q24: Which of the following statements is false?<br>A)

Q43: Which of the following statements is false?<br>A)

Q47: Consider the following equation: E + D

Q86: When a Canadian firm uses debt,the interest

Q93: Which of the following statements is false?<br>A)

Q100: You currently own $100,000 worth of Wal-Mart

Q101: A portfolio weight is _ of individual