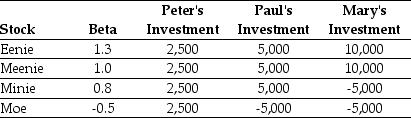

Use the table for the question(s) below.

Consider the following three individuals' portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Paul's portfolio is closest to:

Definitions:

Quantity Supplied

The measure of goods or services available from producers for sale at a particular price.

Equilibrium Price

A market state where the demand for a product matches its supply, resulting in a stable price point.

Quantity Supplied

The amount of a good or service that producers are willing and able to sell at a certain price over a defined period.

Equilibrium Price

The rate at which supply and demand for a specific good or service are equal, creating a stable market condition.

Q5: Which of the following statements is false?<br>A)

Q14: What are the three methods we can

Q23: Which of the following statements is false?<br>A)

Q40: What is a market value balance sheet

Q49: When securities are _,the original shareholders of

Q52: Which of the following equations is incorrect?<br>A)

Q60: Suppose that MI has zero-coupon debt with

Q68: Which of the following statements is false?<br>A)

Q93: What is the difference between common risk

Q97: Two key qualitative factors determine _ of