Use the information for the question(s) below.

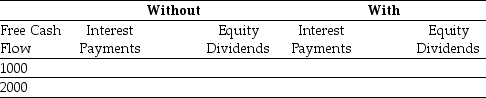

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Reserve Requirement

The minimum amount of reserves that a bank is required to hold by law as a percentage of its deposits, used by central banks to control the money supply.

Open Market Sale

The selling of government bonds and securities in the open market to decrease the money supply.

Money Supply

The whole of economic resources in an economy, represented by cash, coins, and checking and savings accounts' balances, at a given time.

Excess Reserves

Excess reserves refer to the capital reserves held by a bank or financial institution in excess of what is required by regulations, guidelines, or central bank requirements.

Q2: The BIA usually applies to _ while

Q28: Which of the following is NOT an

Q31: Which of the following statements is false?<br>A)

Q34: Monsters' required return is closest to:<br>A) 10.0%<br>B)

Q55: Which of the following statements is false?<br>A)

Q57: Which of the following statements is false?<br>A)

Q62: The income that would be available to

Q77: Which of the following statements is false?<br>A)

Q79: It is only those risks that _

Q90: Which of the following statements is false?<br>A)