Use the information for the question(s) below.

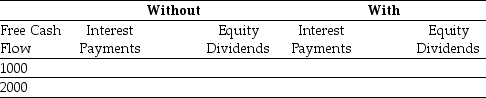

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Standard Deviation

A measure of the amount of variation or dispersion of a set of values.

T Critical Value

The value from the t-distribution that is associated with a specified level of significance for a two-tailed test.

Confidence Levels

Confidence levels are the degree of certainty or probability—expressed as a percentage—that a confidence interval contains the true parameter value.

Alternative Hypothesis

The hypothesis in a statistical test that proposes a specific difference or effect, in contrast to the null hypothesis which suggests no effect.

Q5: Suppose that Gold Digger's beta is -0.8.If

Q33: Suppose Luther Industries is considering divesting one

Q33: Assuming Luther issues a 5:2 stock split,then

Q47: Consider the following equation: r<sub>wacc</sub> = r<sub>U</sub>

Q50: Suppose that to raise the funds for

Q61: From historical data,it has been evident in

Q65: Following the borrowing of $12 million and

Q65: Using the FFC four factor model and

Q73: Which of the following statements is false?<br>A)

Q107: Assuming that Tom wants to maintain the