Use the table for the question(s)below.

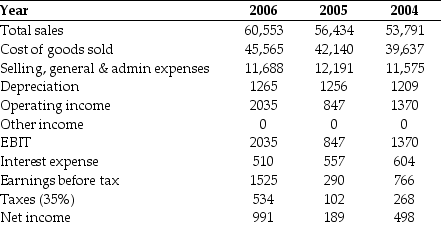

Consider the following income statement for Kroger Inc.(all figures in $ Millions):

-Calculate the interest tax shield,the total amount available to payout to all the investors,and the income that would be available to equity holders if Kroger was not levered for the year 2004.

Definitions:

Contingencies

Potential liabilities or gains that may occur in the future, dependent on the outcome of a specific event.

Federal Income Tax

Federal Income Tax is the tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

FICA Tax

Federal Insurance Contributions Act tax, a mandatory payroll deduction in the United States funding Social Security and Medicare benefits.

Q4: If the market portfolio is efficient,the relationship

Q4: When the market portfolio is not efficient,theory

Q10: The risk-neutral probability of a down state

Q21: The standard deviation of the returns on

Q22: The open interest for a January 2009

Q23: What does the existence of a positive

Q60: What is the market portfolio?

Q80: The initial value of MI's equity without

Q83: Which of the following statements is false?<br>A)

Q88: The reason that the Air Transportation Safety