Use the information for the question(s) below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings, and pays a 35% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

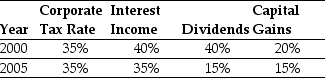

-Assume the following tax schedule:

Personal Tax Rates  Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Definitions:

Automobile Industry

The automobile industry encompasses the wide range of companies and activities involved in the design, manufacturing, marketing, and selling of motor vehicles.

Tobacco Industry

Comprises companies and entities that manufacture, market, and distribute tobacco and tobacco-related products.

Federal Reserve

The central banking system of the United States, responsible for setting monetary policy, regulating banks, maintaining financial stability, and providing banking services.

Board Of Governors

The executive leadership of an institution or organization, such as the Federal Reserve in the United States, responsible for setting policies and overseeing operations.

Q3: The weighted average cost of capital for

Q6: The first step in the APV method

Q10: Assume you want to buy one option

Q18: Describe the two factors that affect the

Q23: What does the existence of a positive

Q34: Canadian investors in U.S.stocks and U.S.investors in

Q36: Consider the following equation: C = P

Q37: The expected return on your investment is

Q52: Which of the following statements is false?<br>A)

Q84: What is the excess return for the