Use the information for the question(s)below.

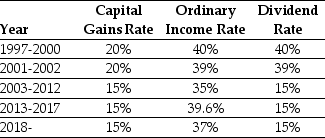

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

-Using the available tax information for 2002,calculate the effective dividend tax rate for a:

(1)one-year individual investor

(2)buy and hold individual investor

(3)pension fund

Definitions:

Inflation Rate

A measure of the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Present Value

The current value of a future sum of money or stream of cash flows given a specified rate of return, often used in the calculation of investment and financing decisions.

PE Ratios

Price-to-Earnings Ratio, a valuation metric for stocks calculated by dividing the market price per share by the earnings per share.

Plowback Ratios

The proportion of earnings retained within a business as retained earnings, rather than being paid out as dividends to investors.

Q1: _ may also reflect a reluctance to

Q7: The monthly lease payments for a four-year

Q8: Which of the following statements regarding the

Q13: Which of the following statements is false?<br>A)

Q23: On the ICE Futures Canada exchange,headquartered in

Q26: The unlevered cost of capital for Anteater

Q33: Assuming Luther issues a 5:2 stock split,then

Q43: Assuming that Kinston has the ability to

Q48: Assume that Omicron uses the entire $50

Q49: Which of the following statements is false?<br>A)