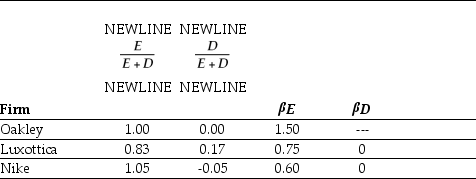

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

Definitions:

Performance Reports

Documented assessments that provide information on the performance of activities, processes, or strategies against planned objectives.

Sales Price Variance

The difference between the actual sales revenue received from a product and the expected revenue, based on the planned selling price and actual quantity sold.

Actual Sales Price

The price at which goods or services are actually sold, which may vary from the list or expected price.

Budgeted Sales Price

Projected price at which a product is expected to be sold, used in financial planning and analysis.

Q17: The term 2/10 net 30 means:<br>A) If

Q17: Which of the following statements is false?<br>A)

Q20: Consider the following equation: <span

Q21: Which of the following statements is false?<br>A)

Q26: When the investment cannot be delayed,the optimal

Q34: What kind of corporate debt must be

Q41: Which of the following statements is false?<br>A)

Q47: You pay $3.25 for a call option

Q51: Based upon Ideko's Sales and Operating Cost

Q83: The NPV for Iota's new project is