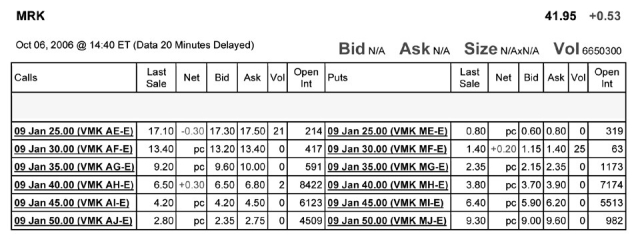

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to sell (write)5 January 2009 put options on Merck with an exercise price of $45 per share.How much money will you receive and are these contracts in or out of the money?

Definitions:

Estuary

A coastal area where freshwater from rivers and streams meets and mixes with saltwater from the ocean.

Oceanic Province

A specific, large region of the ocean that is characterized by its unique physical, chemical, and biological properties.

Continental Shelf

The extended perimeter of each continent, submerged under shallow water, leading to a sharp drop-off known as the continental slope.

Southern Hemisphere

The half of Earth that is south of the equator, known for having reverse seasons compared to the Northern Hemisphere due to its orientation to the sun.

Q3: Which of the following statements is false?<br>A)

Q7: The value today of the investment opportunity

Q13: Which of the following statements is false?<br>A)

Q31: Which of the following statements is false?<br>A)

Q33: The income that would be available to

Q34: Which of the following statements is false?<br>A)

Q47: Consider the following equation: r<sub>wacc</sub> = r<sub>U</sub>

Q54: According to the management entrenchment theory of

Q69: Assume that capital markets are perfect except

Q81: A(n)_ may occur if a major shareholder