Use the information for the question(s) below.

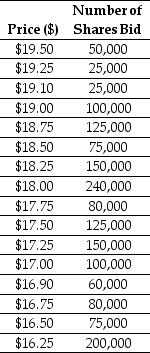

Luther Industries is in the process of selling shares of stock in an auction IPO.At the end of the bidding period,Luther's investment bank has received the following bids:

-The proceeds from the IPO if Luther is selling 1.25 million shares is closest to:

Definitions:

Discounted Cash Flow

A valuation method used to estimate the value of an investment based on its expected future cash flows, adjusting for the time value of money.

Net Present Value

The difference between the present value of cash inflows and outflows over a period of time, used in capital budgeting to assess profitability.

Discount Rate

The discount rate is the interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows.

Working Capital

Working capital is the difference between a company's current assets and current liabilities, indicating the short-term financial health and operational efficiency of the business.

Q4: Based upon the price/earnings ratio,what would be

Q7: Which of the following statements is false?<br>A)

Q19: Consider the following equation: P<sub>cum</sub> - P<sub>ex

Q21: Iota's weighted average cost of capital is

Q21: Which of the following statements is false?<br>A)

Q23: Assume that capital markets are perfect,you issue

Q23: If St.Martin purchases the CT scanner,what is

Q25: If your firm is uninsured,the NPV of

Q32: To cover the costs that result if

Q45: In Canada,_,Section 122.1.a,defines the board's duty to