Use the information for the question(s)below.

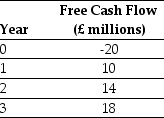

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-What is the dollar present value of the project?

Definitions:

Heteroscedasticity

A condition in regression analysis where the variance of errors or the variability of a dependent variable is unequal across all levels of an independent variable.

Residuals

The differences between observed values and the values predicted by a model, indicating the error in predictions.

Predicted Values

The expected values calculated from a regression or other predictive models based on specific input variables.

API Gravity

A measure used to quantify the density of petroleum liquids relative to water, as defined by the American Petroleum Institute.

Q3: Which of the following statements is false?<br>A)

Q14: Using the equivalent annual benefit method,which project

Q14: Using the binomial pricing model,the calculated price

Q23: Assuming that this is the venture capitalist's

Q26: If the firm can obtain a bank

Q27: You would like to know the

Q31: What are some of the negative effects

Q37: Which of the following statements is false?<br>A)

Q128: Rubidium belongs to the _ group of

Q199: An element has two naturally occurring isotopes.One