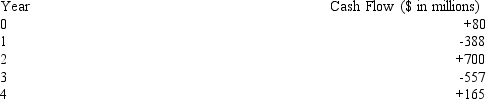

Consider a project with the following stream of cash flows.  What's the IRR of the project? If a firm's cost of capital is 15%,should the firm accept the project?

What's the IRR of the project? If a firm's cost of capital is 15%,should the firm accept the project?

Definitions:

Discount Rate

The interest rate used to discount future cash flows to their present value, essentially reflecting the opportunity cost of capital.

Present Value

The up-to-date valuation of a future financial sum or cash flow sequence, considering a determined rate of return.

Present Value Factor

A factor used to calculate the present value of a future amount of money or stream of payments, based on a specific rate of return.

Discount Factor

A multiplicative factor used to calculate the present value of future cash flows or income streams, reflecting the time value of money.

Q41: Louis International recently conducted an IPO,Louis received

Q53: A portfolio consists 20% of a risk-free

Q59: The 1933 law that prohibited commercial banks

Q60: Financial leverage:<br>A) results when a firm finances

Q62: Quiz Company has a 12 year lease,with

Q71: Based upon the following levels of risk,which

Q73: What is the average return of a

Q80: Which statement is FALSE concerning capital structure?<br>A)

Q84: Emma Bonds will mature in 8 years;

Q91: Everything else being equal a higher corporate