NARRBEGIN: Exhibit 9-2

Exhibit 9-2

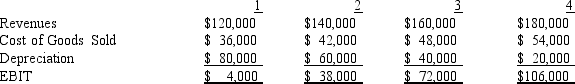

The following data are projected for a possible investment project:

-Refer to Exhibit 9-2.The project requires an initial investment of $300,000 on equipment.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recovered in full at the end of year 4.Equipment will be sold at its book value at the end of year 4.The tax rate is 40%. What is the net cash flow to the firm in year 4?

Definitions:

Process Cost Report

A document in cost accounting that details the production costs for units processed during a period, including materials, labor, and overhead.

Equivalent Units

A concept used in process costing that converts partially completed units into a number of fully completed units for accounting purposes.

Conversion Costs

Conversion costs are the combined costs of direct labor and factory overhead incurred to convert raw materials into finished goods.

FIFO Method

An inventory valuation method where the first goods purchased or produced are the first ones removed from inventory and sold, standing for "first-in, first-out."

Q5: Emma International recently conducted an IPO,Emma received

Q7: If you are anticipating purchasing shares of

Q11: You are asked by the Chief Financial

Q42: Miller Juice,Inc.is expected to pay a $3.00

Q56: What is the net price per share

Q63: What is the WACC for Running Shoes,Inc.?<br>A)

Q79: The drawbacks of going public include all

Q81: The idea that a company may be

Q86: Refer to Bavarian Brewhouse IPO.What are the

Q91: Refer to FAR Corporation.What is the operating