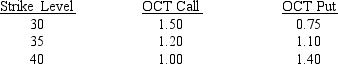

Use the following information on 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.If you used the OCT 35 option to hedge rising rates,and the yield to maturity (YTM) on 13-week bills is 3.75 percent at the option's expiration,what is the outcome of your hedge?

Definitions:

Field Study Research

A research method involving the collection of data outside of a laboratory setting, in the natural environment where phenomena of interest occur.

Spurious

Lacking authenticity or validity in essence or origin; not genuine, false.

Association

A connection or cooperative link between people, organizations, or concepts.

Falls

Incidents where individuals unexpectedly come to rest on the ground or lower level, often leading to injuries, especially among older adults.

Q1: The current foreign exchange rate is also

Q6: Currently the Brazilian Real is trading at

Q32: Hannah Monstz is looking to purchase a

Q55: The data needed to adjust a depositor's

Q62: Suppose you bought 10 Smith Enterprise put

Q63: Considering the following information what is the

Q70: A fully depreciated asset must be:<br>A)removed from

Q97: If the company has $578,000 in funds

Q101: Lower-of-cost-or-market is a method of inventory valuation.

Q105: If the market rate of interest is