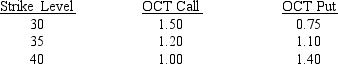

Use the following information on 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.If you used the OCT 35 option to hedge rising rates,and the yield to maturity (YTM) on 13-week bills is 3.75 percent at the option's expiration,what is the outcome of your hedge?

Definitions:

Direct Materials Purchases Variance

The difference between the budgeted cost of materials that should have been purchased for the production volume and the actual cost of materials purchased.

Variable Overhead

Costs that fluctuate with production levels, such as utility bills or raw material costs, that are not directly tied to manufacturing.

Materials Price Variance

The difference between the actual cost of raw materials and the standard (expected) cost, used to assess budgeting efficiency.

Direct Materials Purchases Variance

The difference between the actual cost of direct materials purchased and the expected cost at standard prices.

Q4: Agreements giving the venture capitalists the right

Q11: Refer to Smith Enterprises International Investment.What is

Q11: Backward integration is a type of<br>A) horizontal

Q12: The case of business failure in which

Q14: All bank memorandums reported on the bank

Q34: Income tax based on taxable income may

Q58: You need to purchase coal 4-months from

Q72: Which of the following terms describes when

Q73: A patent was purchased for $585,000 with

Q80: Liabilities due beyond one year are classified