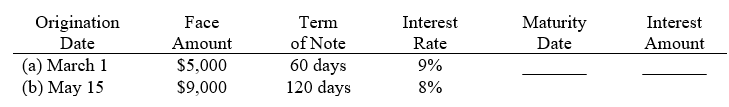

Determine the due date and amount of interest due at maturity on the following notes (Assume 360 days in a year):

Definitions:

Straight-Line Method

A method of calculating the depreciation of an asset that evenly spreads out its cost over its useful life.

Entertainment Expenses

Costs for business-related entertainment that may be partially deductible under certain conditions.

Listed Property

Assets required to be reported for tax purposes because they have the potential for personal use, such as cars, computers, and real property.

Standard Mileage Rate

The IRS-set rate per mile that taxpayers can use to calculate deductions for business, charitable, medical, or moving purposes when using a vehicle.

Q7: You are the manager of a company

Q20: Beginning inventory,purchases,and sales for Product XCX are

Q28: For EFG Co.,the transaction "purchase of store

Q34: A customer's check received in settlement of

Q47: Johnson,Inc.paid rent expense of $3,500 for the

Q54: If paid-in capital in excess of par--preferred

Q78: The inventory costing method that considers the

Q99: When an account is written off under

Q101: The excess of cash flowing in from

Q107: A buyer who acquires merchandise under credit