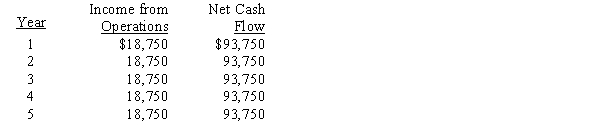

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The present value index for this investment is

Definitions:

Major Organic Product

The principal product formed in a reaction involving organic molecules, which is often the most stable or the one produced in the highest yield under the given conditions.

Major Organic Product

The predominant output resulting from a chemical reaction involving organic reactants, distinguished by its higher yield compared to other products.

Activating Group

A substituent attached to a benzene ring that increases its reactivity by stabilizing the intermediate cation through resonance or electron-donating effects.

Benzene

A cyclic hydrocarbon with the formula C6H6, characterized by its aromaticity, consisting of a ring of six carbon atoms with alternating double and single bonds.

Q6: On the bank's accounting records,customers' accounts are

Q21: Based on the above data,what is the

Q24: Depreciation expense on store equipment for a

Q29: An increase in Stockholders' Equity from revenues

Q38: BlueInk Corporation's accumulated depreciation increased by $14,000,while

Q43: When cash is received in payment of

Q48: Standard costs serve as a device for

Q87: Production estimates for August are as follows:<br>A)$1,260,000

Q92: The accrual basis of accounting recognizes:<br>A)revenues when

Q94: Gross profit percent is calculated by dividing