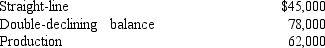

At the end of its first year of operations,Andrews Company calculated its depreciation expense using three different methods.Following are the calculations using these methods:

Net income for Andrews Company using the straight-line method of depreciation is $92,000.Using this information,answer the following questions.calculate the following items:

Net income for Andrews Company using the straight-line method of depreciation is $92,000.Using this information,answer the following questions.calculate the following items:

a.What would net income be using the double-declining balance method?

b.What would net income be using the production method?

Definitions:

Stock Price

The cost at which a share of a company is bought or sold in the stock market.

Interest Rate

is the cost of borrowing money, expressed as a percentage of the total amount loaned, paid to lenders by borrowers for the use of the borrowed funds.

Expected Future Profits

The anticipated earnings or returns a company or investment is predicted to generate in the future, based on current trends or calculations.

Random Walk Theory

A financial theory suggesting that stock market prices evolve according to an unpredictable and random path.

Q41: Why might someone prefer to invest in

Q44: Use the correct number to designate each

Q49: Which of the following is true of

Q67: What is the primary objective of most

Q68: According to generally accepted accounting principles,treasury stock

Q77: The convertibility feature of a bond can

Q79: Henry Corporation has 3,000 shares of $50

Q112: Which of the following is a period

Q146: Stonehurst Corporation is authorized to issue 100,000

Q150: Bamberg Corporation paid employee wages.Indicate which section,if