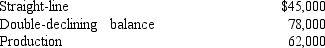

At the end of its first year of operations,Andrews Company calculated its depreciation expense using three different methods.Following are the calculations using these methods:

Net income for Andrews Company using the straight-line method of depreciation is $92,000.Using this information,answer the following questions.calculate the following items:

Net income for Andrews Company using the straight-line method of depreciation is $92,000.Using this information,answer the following questions.calculate the following items:

a.What would net income be using the double-declining balance method?

b.What would net income be using the production method?

Definitions:

Intangible Assets

Intangible assets are non-physical assets possessed by a business, such as patents, trademarks, and copyrights, that have value and give the business certain rights.

Research And Development

Activities related to the innovation, introduction, and improvement of products and processes.

Trade-In Allowance

The credit a buyer receives for turning in an older item (such as a car) when purchasing a new one, reducing the out-of-pocket cost of the new purchase.

List Price

The official selling price of a product or service before any discounts are applied.

Q1: Minority interest may be found in the

Q13: The following comparative balance sheet and other

Q32: Laguna's Corporation purchased treasury stock for $100,000.The

Q44: Although the preparation of a consolidated balance

Q53: For 2013,Castro Corporation had average total assets

Q72: On its December 31,2012,balance sheet,Montrose Corporation reported

Q77: Net cash flows from investing activities would

Q98: Kershaw Company sold an asset that cost

Q125: Analysis of the financing activities section of

Q159: On November 28,2012,Barbour Company purchased 20,000 shares